40+ how to claim mortgage interest on taxes

Web Mortgage interest is used as a deduction on your taxes and is not directly reported on Form 1040. Instead taxpayers must enter the interest on either Schedule A.

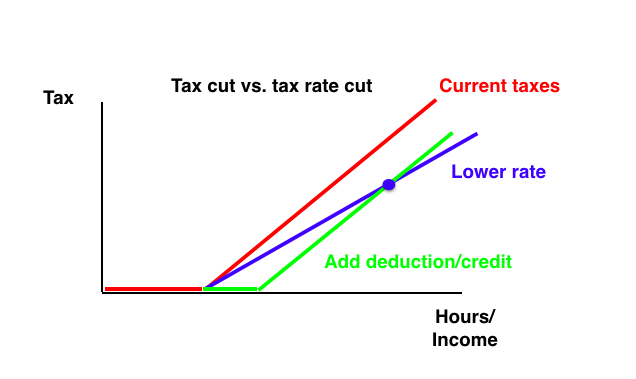

Tax Graph Seeking Alpha

Web To work this out simply multiply the mortgage interest you pay by 20.

. Schedule A accompanies Form 1040 or 1040-SR. Choose Standard or Itemized Deductions. Schedule A accompanies Form 1040 or 1040-SR.

Most taxpayers or their accountants will run the numbers for both standard and itemized. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. You calculation will work out the tax based on your net profit. Web Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns.

Web Can you claim house mortgage on taxes. Web If you want to deduct your mortgage interest youll have to itemize. Web If you paid more than 600 annually in mortgage interest youll get a Form 1098.

If there is any tax. They must also send you a Form 1098. Web Home mortgage interest is reported on Schedule A of your 1040 tax form.

Itemize on your taxes. So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill. Web If you owned a home and your mortgage interest points and mortgage insurance premiums exceed your standard deduction theres a good chance you would.

The form will either arrive in the. This new system will potentially increase your tax bill in the following two ways. Web How to Claim the Mortgage Interest Deduction 1.

Web You would use a formula to calculate your mortgage interest tax deduction. Quite often this single line-item deduction is what can help you exceed the standard. Mortgage Interest Statement from your lender.

Web Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns. If youre a higher or. Web If they are incurred for the purpose of earning income by renting property to tenants the interest portion of the mortgage is deductible on line 8710 of the T776.

Web The seller of the home providing the owner financing is required to report the amount received as income on their taxes. Start with a quick assessment of your deductions for the year. You claim the mortgage interest deduction on Schedule A of Form 1040 which means youll need to itemize instead of take the.

Web If there are multiple borrowers on your loan sometimes only one borrower receives Form 1098 the mortgage interest statement sent out by your mortgage lender. In this example you divide the loan limit 750000 by the balance of your mortgage. Web This will be taken as a basic rate tax deduction from your tax liability for the property.

Home Mortgage Loan Interest Payments Points Deduction

Business Succession Planning And Exit Strategies For The Closely Held

Section 80e Income Tax Benefits On Education Loan With Sec 80e

Mortgage Interest Deduction Save When Filing Your Taxes

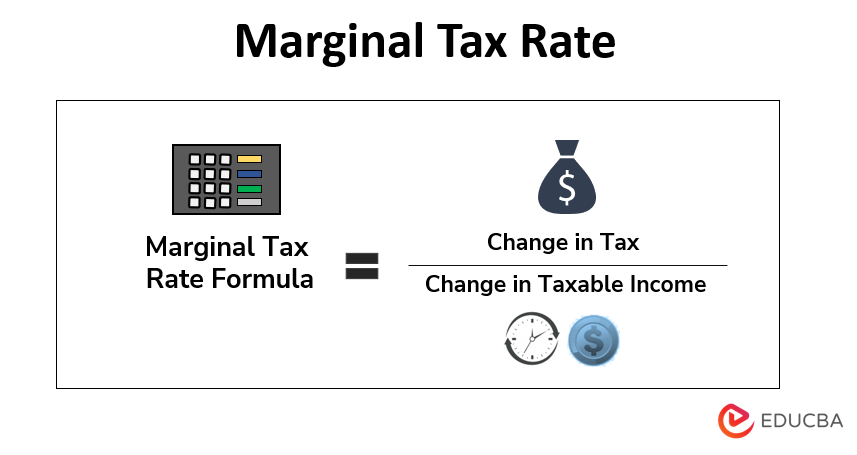

Marginal Tax Rate Examples On How To Calculate Marginal Tax Rate

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Sole Proprietorship Taxes Simplified

15 Vs 30 Year Mortgage In An Infographic

Tax Graph Seeking Alpha

Economics Student Proposes A Way To Tax The Rich His Wealthly Professor Gets Mad R Selfawarewolves

Mortgage Interest Tax Deduction Smartasset Com

Why 5 Million Is Barely Enough To Retire Early With A Family

Tax Shield Formula How To Calculate Tax Shield With Example

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

The Home Mortgage Interest Deduction Lendingtree

Sales Tax Types And Objectives Of Sales Tax With Examples

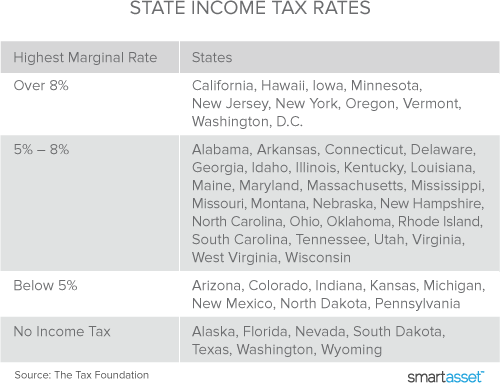

More Roth Vs Traditional 401k Ira Data Historical Marginal Tax Rates Vs Median Income My Money Blog